ULTRA-condensed knowledge

"g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The New World, Leading Tech Companies (1/6/2022) g-f(2)426

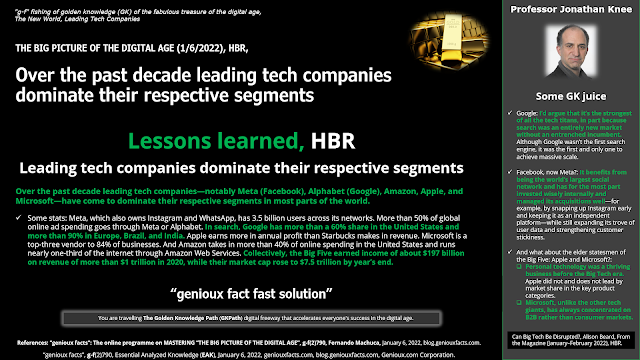

Lessons learned, HBR

EXCEPTIONAL “Full Pack Golden Knowledge Container”

Leading tech companies dominate their respective segments

Over the past decade leading tech companies—notably Meta (Facebook), Alphabet (Google), Amazon, Apple, and Microsoft—have come to dominate their respective segments in most parts of the world.

- Some stats: Meta, which also owns Instagram and WhatsApp, has 3.5 billion users across its networks. More than 50% of global online ad spending goes through Meta or Alphabet. In search, Google has more than a 60% share in the United States and more than 90% in Europe, Brazil, and India. Apple earns more in annual profit than Starbucks makes in revenue. Microsoft is a top-three vendor to 84% of businesses. And Amazon takes in more than 40% of online spending in the United States and runs nearly one-third of the internet through Amazon Web Services. Collectively, the Big Five earned income of about $197 billion on revenue of more than $1 trillion in 2020, while their market cap rose to $7.5 trillion by year’s end.

Genioux knowledge fact condensed as an image

References

Can Big Tech Be Disrupted?, Alison Beard, From the Magazine (January–February 2022), Harvard Business Review, HBR.

ABOUT THE AUTHORS

Jonathan Knee

Biography

Professor Knee teaches Media Mergers and Acquisitions, co-teaches The Media Industries: Public Policy and Business Strategy with Professor Tim Wu of Columbia Law School, and co-teaches Digital Investing with Adjunct Professor Jeremy Philips. He also serves as co-director of the Media & Technology Program with Professor Sarvary. Professor Knee is a Senior Advisor at Evercore Partners. Before joining Evercore as a Senior Managing Director in 2003, Professor Knee was a Managing Director and Co-head of Morgan Stanley's Media Group. He was previously Publishing Sector Head in the Communications, Media and Entertainment Group at Goldman Sachs. Prior to becoming an investment banker, he was Director of International Affairs at United Airlines and served as Adjunct Professor of Law at Northwestern University. His writing has appeared in The Atlantic, Wall Street Journal, New York Times and Washington Post and he is the author of Class Clowns: How the Smartest Investors Lost Billions in Education (2017), co-author of Curse of the Mogul (Portfolio:2009) and author of The Accidental Investment Banker: Inside the Decade that Transformed Wall Street (Oxford: 2006).

Extra-condensed knowledge

Lessons learned, HBR

Some Golden Knowledge (GK) Juice on Strengths

- Google:

- I’d argue that it’s the strongest of all the tech titans, in part because search was an entirely new market without an entrenched incumbent. Although Google wasn’t the first search engine, it was the first and only one to achieve massive scale.

- It also has the best, most well-defended portfolio of reinforcing competitive advantages in that core franchise.

- Facebook, now Meta?:

- It benefits from being the world’s largest social network and has for the most part invested wisely internally and managed its acquisitions well—for example, by snapping up Instagram early and keeping it as an independent platform—while still expanding its trove of user data and strengthening customer stickiness.

- Amazon?

- Did it disrupt Walmart? Absolutely. But Walmart is still a major competitor today, and Amazon is fighting against not only incumbents with established brick-and-mortar footprints and growing online sales (with free shipping to rival Prime) but also focused start-ups like Chewy and direct-to-consumer producers.

- Why did you look at Netflix, too?

- Netflix is a minor player relative to the rest of FAANG [Facebook, Amazon, Apple, Netflix, and Google] but is often mentioned alongside the others because it’s number one in a space—streaming media—that they all think they need to be in.

- Netflix also has an intense culture of operating excellence.

- And what about the elder statesmen of the Big Five: Apple and Microsoft?:

- Personal technology was a thriving business before the Big Tech era. Apple did not and does not lead by market share in the key product categories. But in its primary business, smartphones, while it’s not the biggest, it is the biggest moneymaker—commanding more profits than the rest of the smartphone industry combined—and has the highest market cap, more than $2 trillion. The App Store and Apple ecosystem have created extraordinary shareholder value by monetizing its high-end niche.

- Microsoft, unlike the other tech giants, has always concentrated on B2B rather than consumer markets. After losing its way and ceding the mobile OS market to Google and Apple, it has refocused on improving its core software offerings and expanding its footprint within its corporate customer base while aggressively embracing the cloud. It has established credibility by using data from cloud-based applications to increase its responsiveness and continuously improve.

Condensed knowledge

- CONTEXT: The Golden Knowledge Path ("GKPath") digital highway

- Opportunity, Discovering and exploiting the treasure of the digital age

- "genioux facts", the online programme on MASTERING “THE BIG PICTURE OF THE DIGITAL AGE”, builds The Golden Knowledge Path (GKPath) digital highway to discovering and exploiting the treasure of the digital age, accelerating everyone's success in the digital age. g-f(2)254, g-f(2)260, g-f(2)261, g-f(2)251, g-f(2)312, g-f(2)256, g-f(2)257, g-f(2)272, g-f(2)271, g-f(2)270, g-f(2)268, g-f(2)269, g-f(2)289, g-f(2)283, g-f(2)287, g-f(2)313, g-f(2)293, g-f(2)294, g-f(2)296, g-f(2)298

- The inverted mini pyramid of knowledge, g-f(256), is essential to travel on the "GKPath" highway.

- g-f(2)256 The Big Picture of the Digital Age (5/2/2021), geniouxfacts, The fundamental knowledge mini-pyramid for traveling on the "GKPath" highway.

- Key "genioux facts" to travel on the "GKPath" highway.

- g-f(2)261 The Big Picture of the Digital Age (5/5/2021), geniouxfacts, You are unique. Grow without limits in the digital age.

- g-f(2)257 The Big Picture of the Digital Age (5/3/2021), geniouxfacts, At any moment you take the fastest path (GKPath) to your greatness.

- g-f(2)254 The Big Picture of the Digital Age (5/1/2021), geniouxfacts, The Golden Knowledge Path (GKPath) to accelerate everyone's success.

- g-f(2)260 The Big Picture of the Digital Age (5/4/2021), geniouxfacts, Alerts, Warnings and Relevant Lessons Learned Traveling at High Speed on GKPath.

Lessons learned, HBR

Some Golden Knowledge (GK) Juice on Weaknesses

- Google:

- Yes, it has reorganized and instilled more operating discipline in other areas, but its list of failed launches, from the Nexus smartphone to Google Glass, is long. And its efforts to directly challenge the other tech giants have either collapsed completely or significantly lagged. Google+ was a short-lived challenge to Facebook, and Google Cloud remains far behind Microsoft’s Azure in taking on Amazon Web Services. I don’t think that’s a coincidence.

- When you dominate one segment of the market so overwhelmingly, you’re less likely to build a culture that is optimized to find new ways to grow outside it.

- Facebook, now Meta?:

- Recently exposed internal emails demonstrate that the company is nonetheless well aware of serious threats from competing “social mechanics.” We’re also still waiting to see any ROI on its $19 billion purchase of the messaging app WhatsApp, which almost a decade later remains unprofitable and lacks a real revenue model, and the $2 billion it spent on the virtual reality firm Oculus. And the company is increasingly under fire for its role in spreading misinformation and hate online, which could cause it to lose credibility among users, advertisers, and the next generation of social networkers.

- Amazon?

- Retail remains a difficult, highly competitive business where sustainable advantage is limited. The company has also made some questionable acquisitions: Whole Foods, when grocery is a structurally challenged category, and MGM, in an ill-advised bid to make Prime Video a real rival to Netflix. Investors may think MGM is worth it if only to halt Amazon’s relentless increases in wasteful spending on original content. Yet despite missteps Amazon has a culture of relentlessness and unlike the other tech titans has built some wildly successful unrelated businesses, such as Amazon Web Services, that do lend themselves to strong competitive advantage—in contrast to e-commerce. AWS generates a majority of the overall company’s profits and will probably continue to do so for the indefinite future.

- Why did you look at Netflix, too?

- Its business model is nowhere near as strong as the models that the traditional cable channels it is increasingly replacing used to enjoy. At one time those businesses had fabulous high margins because they benefited from long-term contracts and capacity constraints. Direct-to-consumer streamers like Netflix, by contrast, face relentless customer churn and constant competition from new entrants, including Apple and Amazon and old-timers like HBO, Disney, NBC (with Peacock), and CBS (with Paramount+).

- And what about the elder statesmen of the Big Five: Apple and Microsoft?:

- Apple’s expertise lies in developing revolutionary, sleek devices, but the people who created the ones that define the company are gone. The fact that the company is trying to get into the health care and automotive industries—where it has no track record and innovative incumbents abound—suggests that it realizes it needs to plan for its next act. Though it’s had a terrific run, in the absence of the next generation of revolutionary gadgets, Apple’s continued financial dominance is by no means assured.

- Microsoft faces new competitors that are both massive and nimble, such as Salesforce, whose acquisition of Slack threatens Microsoft’s ambitions in workforce productivity applications.

Some relevant characteristics of this "genioux fact"

- Category 2: The Big Picture of the Digital Age

- [genioux fact deduced or extracted from HBR]

- This is a “genioux fact fast solution.”

- Tag Opportunities those travelling at high speed on GKPath

- Type of essential knowledge of this “genioux fact”: Essential Analyzed Knowledge (EAK).

- Type of validity of the "genioux fact".

- Inherited from sources + Supported by the knowledge of one or more experts.

- Authors of the genioux fact

References

“genioux facts”: The online programme on MASTERING “THE BIG PICTURE OF THE DIGITAL AGE”, g-f(2)790, Fernando Machuca, January 6, 2022, blog.geniouxfacts.com, geniouxfacts.com, Genioux.com Corporation.

“genioux facts”: The online programme on MASTERING “THE BIG PICTURE OF THE DIGITAL AGE”, g-f(2)790, Fernando Machuca, January 6, 2022, blog.geniouxfacts.com, geniouxfacts.com, Genioux.com Corporation.

ABOUT THE AUTHORS

PhD with awarded honors in computer science in France

Fernando is the director of "genioux facts". He is the entrepreneur, researcher and professor who has a disruptive proposal in The Digital Age to improve the world and reduce poverty + ignorance + violence. A critical piece of the solution puzzle is "genioux facts". The Innovation Value of "genioux facts" is exceptional for individuals, companies and any kind of organization.

PhD with awarded honors in computer science in France

Fernando is the director of "genioux facts". He is the entrepreneur, researcher and professor who has a disruptive proposal in The Digital Age to improve the world and reduce poverty + ignorance + violence. A critical piece of the solution puzzle is "genioux facts". The Innovation Value of "genioux facts" is exceptional for individuals, companies and any kind of organization.

Key “genioux facts”

- Some relevant and recent "genioux facts" from the g-f golden knowledge pyramid to master the big picture of the digital age.

- Opportunities updates (1/6/2022) for those traveling at high speed on GKPath!

- Tag Alerts those traveling at high speed on GKPath

- g-f(2)789 THE BIG PICTURE OF THE DIGITAL AGE (1/5/2022), HBR, Can Big Tech Be Disrupted?

- g-f(2)788 The New World (1/5/2022), Bloomberg, Five Things You Need to Know to Start Your Day

- g-f(2)787 THE BIG PICTURE OF THE DIGITAL AGE (1/5/2022), Forbes, Jon Nordmark Builds Iterate.ai As Digital Transformation Accelerator

- g-f(2)786 The colonizers of the New World (1/4/2021), Media, Apple Briefly Tops $3 Trillion Market Cap

- g-f(2)784 THE BIG PICTURE OF THE DIGITAL AGE (1/4/2022), HBR, Celebrating a Century of Change

- g-f(2)783 THE BIG PICTURE OF THE DIGITAL AGE (1/3/2022), FORTUNE, 2022 will be a year of continuing transformation

- g-f(2)782 Lighthouse of the big picture of the digital age (1/3/2022), How Players and Fans of the Sports Industries Can Grow Without Limits in the New World

- g-f(2)781 THE BIG PICTURE OF THE DIGITAL AGE (1/3/2022), HBR, The CEO’s Playbook for a Successful Digital Transformation

- g-f(2)780 THE BIG PICTURE OF THE DIGITAL AGE (1/2/2022), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)779 THE BIG PICTURE OF THE DIGITAL AGE (1/2/2022), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)778 Lighthouse of the big picture of the digital age (1/1/2022), Essential FACT 4: In the New World, the game is transformation

- g-f(2)777 Happy New Year 2022

- g-f(2)776 THE BIG PICTURE OF THE DIGITAL AGE (12/31/2021), WSJ, Google and Tech Rivals Tap Cash Reserves to Realize Cloud Ambitions

- g-f(2)775 THE BIG PICTURE OF THE DIGITAL AGE (12/31/2021), CNBC, The world’s 10 richest people added $402 billion to their fortunes in 2021. Here’s whose net worth grew the most

- g-f(2)774 THE BIG PICTURE OF THE DIGITAL AGE (12/31/2021), CNBC, Microsoft’s market cap grew more than $800 billion in 2021—here’s how it compares to the most valuable companies in the world

- g-f(2)773 Lighthouse of the big picture of the digital age (12/31/2021), Essential 3: GK for you to conquer the New World

- g-f(2)772 Lighthouse of the big picture of the digital age (12/30/2021), Essential 2: The New World must be known to all

- g-f(2)771 Lighthouse of the big picture of the digital age (12/30/2021), Essential 1: The fabulous treasure must be known to all

- g-f(2)770 THE BIG PICTURE OF THE DIGITAL AGE (12/29/2021), Talks at Google, Richard Thaler | Nudge | Talks at Google

- g-f(2)769 THE BIG PICTURE OF THE DIGITAL AGE (12/29/2021), WSJ, Starboard Takes 6.5% Stake Worth Around $800 Million in GoDaddy

- g-f(2)768 THE BIG PICTURE OF THE DIGITAL AGE (12/29/2021), Forbes, Executive To Entrepreneur: How This Founder Is Creating Generational Wealth Through A Family Recipe

- g-f(2)767 THE BIG PICTURE OF THE DIGITAL AGE (12/29/2021), NBA, How the New World can be understood with a travel to the Planet NBA, Nuggets Warriors Thriller

- g-f(2)766 THE BIG PICTURE OF THE DIGITAL AGE (12/28/2021), MIT Sloan Executive Education, Family Business Success Today: Beyond Operations, To Ownership

- g-f(2)765 THE BIG PICTURE OF THE DIGITAL AGE (12/28/2021), VentureBeat, How AI, VR, AR, 5G, and blockchain may converge to power the metaverse

- g-f(2)764 THE BIG PICTURE OF THE DIGITAL AGE (12/28/2021), HBR, Sanofi’s CEO on How Company Culture Can Thrive in a Distributed, Hybrid World

- g-f(2)763 THE BIG PICTURE OF THE DIGITAL AGE (12/27/2021), MIT Sloan Executive Education, Changing Your Leadership: Opportunity for Professional Growth

- g-f(2)762 THE BIG PICTURE OF THE DIGITAL AGE (12/27/2021), yahoo!finance, Global Artificial Intelligence Robots Market, 2021 - 2027

- g-f(2)761 THE BIG PICTURE OF THE DIGITAL AGE (12/26/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)760 THE BIG PICTURE OF THE DIGITAL AGE (12/26/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)759 THE BIG PICTURE OF THE DIGITAL AGE (12/26/2021), geniouxfacts, FACT: In record time, Bing and Yahoo have improved a momentous search

- g-f(2)758 THE BIG PICTURE OF THE DIGITAL AGE (12/25/2021), geniouxfacts, FACT: For billions, “The treasure of the New World” is video games or chests

- g-f(2)757 THE BIG PICTURE OF THE DIGITAL AGE (12/25/2021), geniouxfacts, FACT: For billions “The New World” is a movie

- g-f(2)756 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (12/24/2021), geniouxfacts, 10 key FACTS of artificial intelligence

- g-f(2)755 THE BIG PICTURE OF THE DIGITAL AGE (12/24/2021), geniouxfacts, A FACT is a thing that is known or proved to be true

- g-f(2)754 THE BIG PICTURE OF THE DIGITAL AGE (12/23/2021), geniouxfacts, The sports industries teach you crucially important lessons

- g-f(2)753 THE BIG PICTURE OF THE DIGITAL AGE (12/23/2021), geniouxfacts, “genioux facts fast solution”: “A good listener few words”

- g-f(2)752 THE BIG PICTURE OF THE DIGITAL AGE (12/22/2021), MIT SMR, The Top MIT SMR Articles of 2021

- g-f(2)751 THE BIG PICTURE OF THE DIGITAL AGE (12/22/2021), TMCNET NEWS, Artificial Intelligence Platforms Market to Record 32.12% Y-O-Y Growth Rate in 2021

- g-f(2)750 THE BIG PICTURE OF THE DIGITAL AGE (12/22/2021), HBR, 50 Global Hubs for Top AI Talent

- g-f(2)749 THE BIG PICTURE OF THE DIGITAL AGE (12/22/2021), WaPo, Harvard chemistry professor found guilty of hiding ties to China

- g-f(2)748 THE BIG PICTURE OF THE DIGITAL AGE (12/21/2021), NYT, In a Boston Court, a Harsh Spotlight Falls on a Heavyweight of Science

- g-f(2)747 THE BIG PICTURE OF THE DIGITAL AGE (12/21/2021), MIT News, Characters for good, created by artificial intelligence

- g-f(2)746 THE BIG PICTURE OF THE DIGITAL AGE (12/21/2021), WSJ, The U.S. Pursued Professors Working With China. Cases Are Faltering.

- g-f(2)745 THE BIG PICTURE OF THE DIGITAL AGE (12/20/2021), MIT SMR, Connecting With Customers in the Age of Acceleration

- g-f(2)744 THE BIG PICTURE OF THE DIGITAL AGE (12/20/2021), Computer Weekly, Top 10 artificial intelligence stories of 2021

- g-f(2)743 THE BIG PICTURE OF THE DIGITAL AGE (12/19/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)742 THE BIG PICTURE OF THE DIGITAL AGE (12/19/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)741 THE BIG PICTURE OF THE DIGITAL AGE (12/18/2021), HBR, Digital Transformation Changes How Companies Create Value

- g-f(2)740 THE BIG PICTURE OF THE DIGITAL AGE (12/18/2021), MIT Media Lab, AI-generated characters for supporting personalized learning and well-being

- g-f(2)739 THE BIG PICTURE OF THE DIGITAL AGE (12/18/2021), Business Wire, The UK Leads Europe and Ranks Third Globally in Artificial Intelligence

- g-f(2)738 THE BIG PICTURE OF THE DIGITAL AGE (12/17/2021), Daily Mail, Artificial intelligence can now predict who will develop DEMENTIA with 92% accuracy, breakthrough study reveals

- g-f(2)737 THE BIG PICTURE OF THE DIGITAL AGE (12/16/2021), MIT SMR, How Customer Connections Can Help Drive Decision-Making for Marketers

- g-f(2)736 THE BIG PICTURE OF THE DIGITAL AGE (12/16/2021), The National Interest, The Speed of Warfare Is Getting Faster—Thanks to Artificial Intelligence

- g-f(2)735 THE BIG PICTURE OF THE DIGITAL AGE (12/15/2021), FORTUNE, High-performance computing has become crucial to competitive advantage—in every industry

- g-f(2)734 THE BIG PICTURE OF THE DIGITAL AGE (12/15/2021), WSJ, Hackers Backed by China Seen Exploiting Security Flaw in Internet Software

- g-f(2)733 THE BIG PICTURE OF THE DIGITAL AGE (12/15/2021), Knowledge@Wharton, For the Win: How Immigrant Employees Boost Performance

- g-f(2)732 THE BIG PICTURE OF THE DIGITAL AGE (12/15/2021), LABMATE, What is Artificial Intelligence

- g-f(2)731 THE BIG PICTURE OF THE DIGITAL AGE (12/14/2021), MIT SMR, Why It’s So Hard to Keep and Recruit Employees Right Now

- g-f(2)730 THE BIG PICTURE OF THE DIGITAL AGE (12/14/2021), Knowledge@Wharton, How Big Companies Can Cultivate Intrapreneurs

- g-f(2)729 THE BIG PICTURE OF THE DIGITAL AGE (12/14/2021), McKinsey Global Survey, The state of AI in 2021

- g-f(2)728 THE BIG PICTURE OF THE DIGITAL AGE (12/13/2021), WSJ, India Investigates Hacking of Prime Minister Narendra Modi’s Twitter Account

- g-f(2)727 THE BIG PICTURE OF THE DIGITAL AGE (12/13/2021), nature, DeepMind AI tackles one of chemistry’s most valuable techniques

- g-f(2)726 Lighthouse of the big picture of the digital age (12/13/2021), Golden Knowledge (GK) to enable the colonization the g-f New World

- g-f(2)725 THE BIG PICTURE OF THE DIGITAL AGE (12/12/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)724 THE BIG PICTURE OF THE DIGITAL AGE (12/12/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)723 THE BIG PICTURE OF THE DIGITAL AGE (12/11/2021), WSJ, Computers Revolutionized Chess. Magnus Carlsen Wins by Being Human

- g-f(2)722 THE BIG PICTURE OF THE DIGITAL AGE (12/11/2021), NYT, We’re Living Through the ‘Boring Apocalypse’

- g-f(2)721 THE BIG PICTURE OF THE DIGITAL AGE (12/10/2021), WSJ, 10 Tech Events of 2021 That Will Shape the Future

- g-f(2)720 THE BIG PICTURE OF THE DIGITAL AGE (12/10/2021), LinkedIn, Current Status of Artificial Intelligence

- g-f(2)719 THE BIG PICTURE OF THE DIGITAL AGE (12/10/2021), yahoo!finance, Survey suggests 84% of Americans are illiterate about AI — so here’s a quiz to test your own AI IQ

- g-f(2)718 THE BIG PICTURE OF THE DIGITAL AGE (12/9/2021), The Harvard Gazette, Negotiating the irrational with Daniel Kahneman

- g-f(2)717 THE BIG PICTURE OF THE DIGITAL AGE (12/9/2021), WaPo, New artificial intelligence tool detects most common climate falsehoods

- g-f(2)716 THE BIG PICTURE OF THE DIGITAL AGE (12/9/2021), National Law Review, How Perfect Will AI Need to Be?

- g-f(2)715 THE BIG PICTURE OF THE DIGITAL AGE (12/8/2021), HBS, Takeaways from Professor Linda Hill’s discussions with global executives

- g-f(2)714 THE BIG PICTURE OF THE DIGITAL AGE (12/8/2021), yahoo!finance, The healthcare artificial intelligence market is expected to reach USD 44.5 billion by 2026

- g-f(2)713 THE BIG PICTURE OF THE DIGITAL AGE (12/8/2021), The Harvard Gazette, New University-wide institute to integrate natural, artificial intelligence

- g-f(2)712 THE BIG PICTURE OF THE DIGITAL AGE (12/8/2021), MIT SMR, Winter 2022 Issue is an EXCEPTIONAL “Full Pack Golden Knowledge Container”

- g-f(2)711 THE BIG PICTURE OF THE DIGITAL AGE (12/7/2021), WSJ, AI Agriculture Startups Take In Record Amount of VC Funding

- g-f(2)710 THE BIG PICTURE OF THE DIGITAL AGE (12/7/2021), geniouxfacts, How Stephen Curry has used the treasure of the digital age to help improve shot

- g-f(2)709 Lighthouse of the big picture of the digital age (12/7/2021), Sports industries build a two-way digital bridge to the g-f New World

- g-f(2)708 THE BIG PICTURE OF THE DIGITAL AGE (12/6/2021), yahoo!finance, Cision, Artificial Intelligence in the Global Healthcare Market 2021-2025: A US$22.68 Billion Market by 2025

- g-f(2)707 THE BIG PICTURE OF THE DIGITAL AGE (12/6/2021), geniouxfacts, A Stanford Playlist That Is An Exceptional "Full Pack Golden Knowledge Container" On AI

- g-f(2)706 THE BIG PICTURE OF THE DIGITAL AGE (12/5/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)705 THE BIG PICTURE OF THE DIGITAL AGE (12/5/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)704 THE BIG PICTURE OF THE DIGITAL AGE (12/4/2021), geniouxfacts, The essential: Proper grassroots knowledge will trigger your growth without limits

- g-f(2)703 THE BIG PICTURE OF THE DIGITAL AGE (12/3/2021), MIT SMR + BCG, ME, MYSELF AND AI, EPISODE 304, is an exceptional "Full Pack Golden Knowledge Container"

- g-f(2)702 THE BIG PICTURE OF THE DIGITAL AGE (12/3/2021), HBR, Former Best Buy CEO Hubert Joly: Empowering Workers to Create ‘Magic’

- g-f(2)701 THE BIG PICTURE OF THE DIGITAL AGE (12/3/2021), Aljazeera, Artificial intelligence must not exacerbate inequality further

- g-f(2)700 THE BIG PICTURE OF THE DIGITAL AGE (12/2/2021), geniouxfacts, The video “Don't Believe Everything You Think | Lauren Weinstein | TEDxPaloAlto” is an exceptional “Full Pack Golden Knowledge Container”

- g-f(2)699 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Videos That Are Containers Of Golden Knowledge (GK) In Current AI Use Cases (12/2/2021)

- g-f(2)698 THE BIG PICTURE OF THE DIGITAL AGE (12/1/2021), Daily Nous, Multi-Million Euro Award for Philosopher of Artificial Intelligence

- g-f(2)697 THE BIG PICTURE OF THE DIGITAL AGE (12/1/2021), msn, Newsweek, Fitness Enthusiast Who Died of COVID Didn't Want to Be 'Guinea Pig' With Vaccine

- g-f(2)696 THE BIG PICTURE OF THE DIGITAL AGE (12/1/2021), geniouxfacts, The video “Google's Next $1 Trillion Opportunity” is an exceptional “Full Pack Golden Knowledge Container”

- g-f(2)695 THE BIG PICTURE OF THE DIGITAL AGE (11/29/2021), Forbes, How Artificial Intelligence And Machine Learning Are Transforming The Future Of Renewable Energy

- g-f(2)694 THE BIG PICTURE OF THE DIGITAL AGE (11/30/2021), MIT SMR, Transforming From Traditional Competitor to Ecosystem Powerhouse

- g-f(2)693 THE BIG PICTURE OF THE DIGITAL AGE (11/29/2021), MIT SMR, Competing on Platforms

- g-f(2)692 THE BIG PICTURE OF THE DIGITAL AGE (11/29/2021), WSJ, Move Over, GE. The Tech Conglomerates Are the New Leaders of Industry.

- g-f(2)691 THE BIG PICTURE OF THE DIGITAL AGE (11/29/2021), MIT News, Artificial intelligence that understands object relationships

- g-f(2)690 THE BIG PICTURE OF THE DIGITAL AGE (11/29/2021), INSEAD, Strategic Thinking with Game Theory

- g-f(2)689 THE BIG PICTURE OF THE DIGITAL AGE (11/28/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)688 THE BIG PICTURE OF THE DIGITAL AGE (11/28/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)687 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in AI (11/27/2021)

- g-f(2)686 THE BIG PICTURE OF THE DIGITAL AGE (11/27/2021), UNESCO, UNESCO member states adopt the first ever global agreement on the Ethics of Artificial Intelligence

- g-f(2)685 THE BIG PICTURE OF THE DIGITAL AGE (11/26/2021), Phys.Org, Universitat Oberta de Catalunya, Using sensors and artificial intelligence boosts profitability of agricultural facilities

- g-f(2)684 THE BIG PICTURE OF THE DIGITAL AGE (11/26/2021), WWU Muenster, Why AI simultaneously gives rise to both euphoria and fear

- g-f(2)683 THE BIG PICTURE OF THE DIGITAL AGE (11/25/2021), INC., Why Emotionally Intelligent People Embrace Artificial Intelligence

- g-f(2)682 THE BIG PICTURE OF THE DIGITAL AGE (11/25/2021), Forbes, Highest-Paid Athletes 2021: All-Time Highs For NFL, NBA And Soccer Players, And More Numbers To Know

- g-f(2)681 THE BIG PICTURE OF THE DIGITAL AGE (11/25/2021), geniouxfacts, A foundational golden knowledge juice on the transformative power of gratitude

- g-f(2)680 THE BIG PICTURE OF THE DIGITAL AGE (11/24/2021), Nobel Prize, Nobel Prize laureates in conversation. United by Science - Nobel Prize Dialogue 2021.

- g-f(2)679 THE BIG PICTURE OF THE DIGITAL AGE (11/24/2021), nature, Artificial intelligence powers protein-folding predictions

- g-f(2)678 THE BIG PICTURE OF THE DIGITAL AGE (11/24/2021), MIT SMR, Critical Success Factors for Achieving ROI From AI Initiatives

- g-f(2)677 THE BIG PICTURE OF THE DIGITAL AGE (11/23/2021), INSEAD, Twin Transformation: How to Master Digital & Sustainable Transitions? w/Accenture & Intesa Sanpaolo

- g-f(2)676 THE BIG PICTURE OF THE DIGITAL AGE (11/23/2021), geniouxfacts, A fundamental golden knowledge juice on digital transformation (DT)

- g-f(2)675 THE BIG PICTURE OF THE DIGITAL AGE (11/22/2021), HBR, Drive Innovation with Better Decision-Making

- g-f(2)674 THE BIG PICTURE OF THE DIGITAL AGE (11/22/2021), geniouxfacts, A fundamental golden knowledge juice in artificial intelligence

- g-f(2)673 THE BIG PICTURE OF THE DIGITAL AGE (11/21/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)672 THE BIG PICTURE OF THE DIGITAL AGE (11/21/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)671 THE BIG PICTURE OF THE DIGITAL AGE (11/21/2021), geniouxfacts, 10 videos that are containers of golden knowledge (GK) in metaverse

- g-f(2)670 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in AI (11/20/2021)

- g-f(2)669 THE BIG PICTURE OF THE DIGITAL AGE (11/20/2021), geniouxfacts, There is a clear path to achieve your greatness

- g-f(2)668 THE BIG PICTURE OF THE DIGITAL AGE (11/19/2021), geniouxfacts, 10 Containers of Golden Knowledge about Metaverse

- g-f(2)667 THE BIG PICTURE OF THE DIGITAL AGE (11/19/2021), geniouxfacts, The pyramid of golden knowledge of a “genioux fact”: From GOLDEN FRUITS to GOLDEN JUICES

- g-f(2)666 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in DT (11/18/2021)

- g-f(2)665 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in AI (11/18/2021)

- g-f(2)664 THE BIG PICTURE OF THE DIGITAL AGE (11/17/2021), geniouxfacts, A story of ultra-condensed knowledge to grow without limits

- g-f(2)663 THE BIG PICTURE OF THE DIGITAL AGE (11/17/2021), MIT SMR, Adopt Open Strategy to Fuel Innovation

- g-f(2)662 THE BIG PICTURE OF THE DIGITAL AGE (11/17/2021), ZDNet, Artificial intelligence: everyone wants it, but not everyone is ready

- g-f(2)661 THE BIG PICTURE OF THE DIGITAL AGE (11/17/2021), Bloomberg, Metaverse Is a Multitrillion-Dollar Opportunity, Epic CEO Says

- g-f(2)660 THE BIG PICTURE OF THE DIGITAL AGE (11/16/2021), MIT SMR + BCG, ME, MYSELF AND AI, EPISODE 303, is an exceptional "Full Pack Golden Knowledge Container"

- g-f(2)659 Cision, yahoo!finance, Artificial Intelligence Market size worth $ 641.30 Billion, Globally, by 2028 at 36.1% CAGR: Verified Market Research®

- g-f(2)658 THE BIG PICTURE OF THE DIGITAL AGE (11/15/2021), VentureBeat, Why Microsoft may beat Zuckerberg to the metaverse

- g-f(2)657 THE BIG PICTURE OF THE DIGITAL AGE (11/14/2021), Economist Impact, sponsored by Google Workspace, Making hybrid work human

- g-f(2)656 THE BIG PICTURE OF THE DIGITAL AGE (11/15/2021), MIT SMR + BCG, ME, MYSELF AND AI, EPISODE 302, is an exceptional "Full Package Golden Knowledge Container"

- g-f(2)655 THE BIG PICTURE OF THE DIGITAL AGE (11/14/2021), HBR, MBA Programs Need an Update for the Digital Era

- g-f(2)654 THE BIG PICTURE OF THE DIGITAL AGE (11/14/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)653 THE BIG PICTURE OF THE DIGITAL AGE (11/14/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)652 THE BIG PICTURE OF THE DIGITAL AGE (11/13/2021), geniouxfacts, The video “Microsoft Ignite Opening | KEY01” is an exceptional “Full Pack Golden Knowledge Container”

- g-f(2)651 THE BIG PICTURE OF THE DIGITAL AGE (11/13/2021), Big Think, The “Eureka myth”: Why big ideas don’t form in a single moment

- g-f(2)650 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Golden Knowledge Videos of the Week on Digital Transformation (11/12/2021)

- g-f(2)649 THE BIG PICTURE OF THE DIGITAL AGE (11/12/2021), geniouxfacts, How the Treasure of the Digital Age Helps You

- g-f(2)648 THE BIG PICTURE OF THE DIGITAL AGE (11/11/2021), WSJ, GE Was Once a Model for Siemens but Now Follows Its Rival’s Path

- g-f(2)647 THE BIG PICTURE OF THE DIGITAL AGE (11/11/2021), HBR, Managing AI Decision-Making Tools

- g-f(2)646 THE BIG PICTURE OF THE DIGITAL AGE (11/10/2021), WSJ, Big Tech Seeks Its Next Fortune in the Metaverse

- g-f(2)645 THE BIG PICTURE OF THE DIGITAL AGE (11/9/2021), Forbes, ‘Every Firm Is Talking About It’: Venture Capital Is Having Its New York Moment

- g-f(2)644 THE BIG PICTURE OF THE DIGITAL AGE (11/9/2021), HBR, How No-Code Platforms Can Bring AI to Small and Midsize Businesses

- g-f(2)643 THE BIG PICTURE OF THE DIGITAL AGE (11/9/2021), geniouxfacts, There is an appetite problem for golden knowledge (GK)

- g-f(2)642 THE BIG PICTURE OF THE DIGITAL AGE (11/8/2021), geniouxfacts, Gerald Kane - An Exceptional Producer of Golden Knowledge (GK)

- g-f(2)641 Lighthouse of the big picture of the digital age (11/8/2021), The evolution of the g-f New World powered by three powerful engines

- g-f(2)640 THE BIG PICTURE OF THE DIGITAL AGE (11/7/2021), MIT SMR, Artificial Intelligence in the business world

- g-f(2)639 THE BIG PICTURE OF THE DIGITAL AGE (11/7/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)638 THE BIG PICTURE OF THE DIGITAL AGE (11/7/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)637 THE BIG PICTURE OF THE DIGITAL AGE (11/6/2021), geniouxfacts, 10 Containers of Golden Knowledge about Metaverse

- g-f(2)636 THE BIG PICTURE OF THE DIGITAL AGE (11/6/2021), Analytics Insight, How Is Artificial Intelligence Going to Redefine Leadership in 2021?

- g-f(2)635 THE BIG PICTURE OF THE DIGITAL AGE (11/6/2021), MarketWatch, Nvidia tops $700 billion valuation for first time as optimism grows for ‘metaverse’ opportunity

- g-f(2)634 THE BIG PICTURE OF THE DIGITAL AGE (11/5/2021), WSJ, How to Fix Social Media

- g-f(2)633 THE BIG PICTURE OF THE DIGITAL AGE (11/5/2021), VB, Nexon boss wants to move past the vague promises of the ‘metaverse’

- g-f(2)632 THE BIG PICTURE OF THE DIGITAL AGE (11/5/2021), MIT News, Mark Vogelsberger: Simulating galaxy formation for clues to the universe

- g-f(2)631 THE BIG PICTURE OF THE DIGITAL AGE (11/4/2021), MIT SMR + BCG, The Cultural Benefits of Artificial Intelligence in the Enterprise

- g-f(2)630 THE BIG PICTURE OF THE DIGITAL AGE (11/4/2021), WSJ, Google Invests $1 Billion in Exchange Giant CME, Strikes Cloud Deal

- g-f(2)629 THE BIG PICTURE OF THE DIGITAL AGE (11/4/2021), geniouxfacts, The MIT SMR + BCG report is an exceptional “Full Pack Golden Knowledge Container”

- g-f(2)628 THE BIG PICTURE OF THE DIGITAL AGE (11/3/2021), Forbes, What Is The Metaverse—And Why Does Mark Zuckerberg Care So Much About It?

- g-f(2)627 THE BIG PICTURE OF THE DIGITAL AGE (11/3/2021), WSJ, Qualcomm Posts Record Sales Amid Surging Demand for 5G Smartphones

- g-f(2)626 THE BIG PICTURE OF THE DIGITAL AGE (11/3/2021), MIT SMR + BCG, Outstanding Research Report on AI

- g-f(2)625 THE BIG PICTURE OF THE DIGITAL AGE (11/3/2021), WSJ, Tariffs to Tackle Climate Change Gain Momentum. The Idea Could Reshape Industries.

- g-f(2)624 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Golden Knowledge Videos of the Week on Digital Transformation (11/2/2021)

- g-f(2)623 THE BIG PICTURE OF THE DIGITAL AGE (11/2/2021), MIT News, Avoiding shortcut solutions in artificial intelligence

- g-f(2)622 THE BIG PICTURE OF THE DIGITAL AGE (11/2/2021), geniouxfacts, Top "genioux facts" of ultra-condensed GK

- g-f(2)621 THE BIG PICTURE OF THE DIGITAL AGE (11/1/2021), HBR, Forget Flexibility. Your Employees Want Autonomy.

- g-f(2)620 THE BIG PICTURE OF THE DIGITAL AGE (11/1/2021), PDT: Win your challenge to find the right balance between running and transforming!

- g-f(2)619 THE BIG PICTURE OF THE DIGITAL AGE (11/1/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)618 THE BIG PICTURE OF THE DIGITAL AGE (10/31/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)617 Lighthouse of the big picture of the digital age (10/31/2021), THE CHALLENGE: Finding the Right Balance Between Running and Changing

- g-f(2)616 THE BIG PICTURE OF THE DIGITAL AGE (10/30/2021), Gartner, Gartner Top Strategic Technology Trends for 2022

- g-f(2)615 THE BIG PICTURE OF THE DIGITAL AGE (10/30/2021), Gartner, 2021-2023 Emerging Technology Roadmap for Large Enterprises

- g-f(2)614 THE BIG PICTURE OF THE DIGITAL AGE (10/30/2021), The Motley Fool, Artificial Intelligence Makes Energy 40% Cheaper for Alphabet

- g-f(2)613 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in AI (10/29/2021)

- g-f(2)612 THE BIG PICTURE OF THE DIGITAL AGE (10/29/2021), HBR, Microsoft’s Satya Nadella on Flexible Work, the Metaverse, and the Power of Empathy

- g-f(2)611 THE BIG PICTURE OF THE DIGITAL AGE (10/29/2021), MIT SMR, Rethinking Assumptions About How Employees Work

- g-f(2)610 THE BIG PICTURE OF THE DIGITAL AGE (10/28/2021), MIT SMR, Exceptional Golden Knowledge Promotion

- g-f(2)609 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, 10 Containers of Golden Knowledge in AI (10/28/2021)

- g-f(2)608 THE BIG PICTURE OF THE DIGITAL AGE (10/27/2021), Insead Knowledge, The World’s Most Talent Competitive Countries, 2021

- g-f(2)607 THE BIG PICTURE OF THE DIGITAL AGE (10/27/2021), WSJ, Google Nearly Doubles Profit Behind Red-Hot Ad Market

- g-f(2)606 THE BIG PICTURE OF THE DIGITAL AGE (10/26/2021), WSJ, Microsoft Earnings Jump as Cloud Services Thrive

- g-f(2)605 THE BIG PICTURE OF THE DIGITAL AGE (10/27/2021), TechTalks, Stanford reinforcement learning system simulates evolution

- g-f(2)604 The Big Picture of The Digital Age (10/26/2021), geniouxfacts, 10 RELEVANT RECENT GOLDEN KNOWLEDGE in Digital Transformation (DT)

- g-f(2)603 The Big Picture of The Digital Age (10/26/2021), geniouxfacts, 10 RELEVANT RECENT GOLDEN KNOWLEDGE in AI

- g-f(2)602 THE BIG PICTURE OF THE DIGITAL AGE (10/26/2021), geniouxfacts, The New Key Outcome of Our Research on "The Big Picture of the Digital Age"

- g-f(2)601 Lighthouse of the big picture of the digital age (10/26/2021), We live in the age of light that illuminates the path to greatness

- g-f(2)600 THE BIG PICTURE OF THE DIGITAL AGE (10/25/2021), MIT Technology Review, How AI is reinventing what computers are

- g-f(2)599 THE BIG PICTURE OF THE DIGITAL AGE (10/25/2021), NATO, An Artificial Intelligence Strategy for NATO

- g-f(2)598 THE BIG PICTURE OF THE DIGITAL AGE (10/25/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)597 THE BIG PICTURE OF THE DIGITAL AGE (10/25/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)596 THE BIG PICTURE OF THE DIGITAL AGE (10/24/2021), HBR, HBR's Goldmine of Knowledge: Current Issue, Nov-Dec 2021

- g-f(2)595 THE BIG PICTURE OF THE DIGITAL AGE (10/24/2021), MIT SMR, The Collective Intelligence of Remote Teams

- g-f(2)594 THE BIG PICTURE OF THE DIGITAL AGE (10/24/2021), ZDNet, Artificial intelligence sees more funding, but needs more people and better data

- g-f(2)593 Lighthouse of the big picture of the digital age (10/23/2021), Train your mind to think wisely

- g-f(2)592 THE BIG PICTURE OF THE DIGITAL AGE (10/23/2021), MIT SMR, The Real Deal About Synthetic Data

- g-f(2)591 THE BIG PICTURE OF THE DIGITAL AGE (10/22/2021), MIT SMR, A Digital Thread: Capitalize on Your Data’s Value

- g-f(2)590 THE BIG PICTURE OF THE DIGITAL AGE (10/22/2021), MIT NEWS, At Mass STEM Week kickoff, MIT RAISE announces Day of AI

- g-f(2)589 THE BIG PICTURE OF THE DIGITAL AGE (10/21/2021), HBR, The Facebook Trap

- g-f(2)588 THE BIG PICTURE OF THE DIGITAL AGE (10/21/2021), Antonio Grasso, Medium, Google Distributed Cloud: Our Bridge to the Post-Digital Era

- g-f(2)587 THE BIG PICTURE OF THE DIGITAL AGE (10/21/2021), WSJ, Ransomware Gang Masquerades as Real Company to Recruit Tech Talent

- g-f(2)586 THE BIG PICTURE OF THE DIGITAL AGE (10/21/2021), U.S. Air Force, US, UK research labs collaborate on autonomy, artificial intelligence

- g-f(2)585 THE BIG PICTURE OF THE DIGITAL AGE (10/20/2021), MIT SMR, Democratizing Data in Hollywood: Jumpcut’s Kartik Hosanagar

- g-f(2)584 THE BIG PICTURE OF THE DIGITAL AGE (10/20/2021), HBR, The 5 Fronts of Digital Transformation in the Middle Market

- g-f(2)583 THE BIG PICTURE OF THE DIGITAL AGE (10/20/2021), MIT News, One giant leap for the mini cheetah

- g-f(2)582 Lighthouse of the big picture of the digital age (10/19/2021), Build the brain you want: PRACTICE, you have to get the job done!

- g-f(2)581 THE BIG PICTURE OF THE DIGITAL AGE (10/19/2021), SciTechDaily, Developing Artificial Intelligence That “Thinks” Like Humans

- g-f(2)580 THE BIG PICTURE OF THE DIGITAL AGE (10/19/2021), MIT News, Artificial networks learn to smell like the brain

- g-f(2)579 THE BIG PICTURE OF THE DIGITAL AGE (10/18/2021), HBR, Automating Data Analysis Is a Must for Midsize Businesses

- g-f(2)578 THE BIG PICTURE OF THE DIGITAL AGE (10/18/2021), Analytics Insight, 10 Reasons Why AI Is Essential for Your Competitive Intelligence Program

- g-f(2)577 THE BIG PICTURE OF THE DIGITAL AGE (10/18/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)576 THE BIG PICTURE OF THE DIGITAL AGE (10/17/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)575 THE BIG PICTURE OF THE DIGITAL AGE (10/17/2021), MIT SMR, Three Steps to Building a Learning Culture That Delivers Innovation

- g-f(2)574 THE BIG PICTURE OF THE DIGITAL AGE (10/17/2021), ZDNet, Artificial intelligence's data problem meets AI's people problem

- g-f(2)573 THE BIG PICTURE OF THE DIGITAL AGE (10/16/2021), VentureBeat, The 2021 machine learning, AI, and data landscape

- g-f(2)572 THE BIG PICTURE OF THE DIGITAL AGE (10/16/2021), geniouxfacts, Ultra-condensed juice of golden knowledge to grow without limits

- g-f(2)571 Lighthouse of the big picture of the digital age (10/16/2021), Nurture Your Fabulous Brain with Golden Knowledge (GK)

- g-f(2)570 THE BIG PICTURE OF THE DIGITAL AGE (10/15/2021), PHYS.ORG, Machine-learning system accelerates discovery of new materials for 3D printing

- g-f(2)569 THE BIG PICTURE OF THE DIGITAL AGE (10/15/2021), PHYS.ORG, Artificial intelligence helps to find new natural substances

- g-f(2)568 THE BIG PICTURE OF THE DIGITAL AGE (10/15/2021), MIT SMR, The Human Factor in AI-Based Decision-Making

- g-f(2)567 THE BIG PICTURE OF THE DIGITAL AGE (10/14/2021), Stanford HAI, Peter Norvig: Today’s Most Pressing Questions in AI Are Human-Centered

- g-f(2)566 THE BIG PICTURE OF THE DIGITAL AGE (10/14/2021), MIT News, These neural networks know what they’re doing

- g-f(2)565 Lighthouse of the big picture of the digital age (10/14/2021), We Are Truly Living In The Era Of Unlimited Human Growth

- g-f(2)564 THE BIG PICTURE OF THE DIGITAL AGE (10/13/2021), Forbes, Top 10 Digital Transformation Trends For 2022

- g-f(2)563 THE BIG PICTURE OF THE DIGITAL AGE (10/13/2021), geniouxfacts, 10 relevant containers of golden knowledge (GK) in AI

- g-f(2)562 THE BIG PICTURE OF THE DIGITAL AGE (10/13/2021), HBR, What Motivates Lifelong Learners

- g-f(2)561 Lighthouse of the big picture of the digital age (10/12/2021)

- g-f(2)560 THE BIG PICTURE OF THE DIGITAL AGE (10/12/2021), geniouxfacts, 10 relevant containers of golden knowledge (GK) in AI

- g-f(2)559 THE BIG PICTURE OF THE DIGITAL AGE (10/11/2021), WSJ, The Real Meaning of Freedom at Work

- g-f(2)558 THE BIG PICTURE OF THE DIGITAL AGE (10/11/2021), HBR, How Midsize Companies Can Compete in AI

- g-f(2)557 THE BIG PICTURE OF THE DIGITAL AGE (10/11/2021), geniouxfacts, The hope: the growth potential is unlimited

- g-f(2)556 THE BIG PICTURE OF THE DIGITAL AGE (10/10/2021), geniouxfacts, The 10 most read "genioux facts" of the month

- g-f(2)555 THE BIG PICTURE OF THE DIGITAL AGE (10/10/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)554 THE BIG PICTURE OF THE DIGITAL AGE (10/9/2021), Forbes, 10 Attributes Of Successful Digital Business Transformation

- g-f(2)553 THE BIG PICTURE OF THE DIGITAL AGE (10/9/2021), Tech Xplore, Engineers 3D-print personalized, wireless wearables that never need a charge

- g-f(2)552 THE BIG PICTURE OF THE DIGITAL AGE (10/9/2021), United Nations, Artificial intelligence can help halve road deaths by 2030

- g-f(2)551 THE BIG PICTURE OF THE DIGITAL AGE (10/8/2021), geniouxfacts, The three elements of the treasure

- g-f(2)550 THE BIG PICTURE OF THE DIGITAL AGE (10/8/2021), The Motley Fool, What Is Artificial Intelligence?

- g-f(2)549 THE BIG PICTURE OF THE DIGITAL AGE (10/8/2021), Forbes, What Is Artificial Intelligence?

- g-f(2)548 THE BIG PICTURE OF THE DIGITAL AGE (10/7/2021), MIT SMR, AI-at-Scale Hinges on Gaining a ‘Social License’

- g-f(2)547 THE BIG PICTURE OF THE DIGITAL AGE (10/7/2021), Forbes, Five Creative Ways To Lead A Digital Transformation

- g-f(2)546 THE BIG PICTURE OF THE DIGITAL AGE (10/7/2021), MIT SMR, Building an Organizational Approach to Responsible AI

- g-f(2)545 THE BIG PICTURE OF THE DIGITAL AGE (10/6/2021), HBR, The Secret Behind Successful Corporate Transformations

- g-f(2)544 THE BIG PICTURE OF THE DIGITAL AGE (10/6/2021), MIT Technology Review, DeepMind’s AI predicts almost exactly when and where it’s going to rain

- g-f(2)543 THE BIG PICTURE OF THE DIGITAL AGE (10/6/2021), The Motley Fool, Google's DeepMind Artificial Intelligence Unit Is No Longer a Money Loser

- g-f(2)542 THE BIG PICTURE OF THE DIGITAL AGE (10/5/2021), IEEE Spectrum, Microsoft Predicts Weather for Individual Farms

- g-f(2)541 THE BIG PICTURE OF THE DIGITAL AGE (10/5/2021), geniouxfacts, The treasure of the digital age allows you to build the brain you want

- g-f(2)540 THE BIG PICTURE OF THE DIGITAL AGE (10/5/2021), geniouxfacts, Your growth shoots up with three addends: UAI + AI + PDT

- g-f(2)539 THE BIG PICTURE OF THE DIGITAL AGE (10/4/2021), WSJ, Apple Doesn’t Make Videogames. But It’s the Hottest Player in Gaming.

- g-f(2)538 THE BIG PICTURE OF THE DIGITAL AGE (10/4/2021), Fortune, Most Powerful Women

- g-f(2)537 THE BIG PICTURE OF THE DIGITAL AGE (10/4/2021), MIT SMR, EXECUTIVE GUIDE, Developing an Ethical Technology Mindset

- g-f(2)536 THE BIG PICTURE OF THE DIGITAL AGE (10/3/2021), MIT Sloan, How big firms leverage artificial intelligence for competitive advantage

- g-f(2)535 THE BIG PICTURE OF THE DIGITAL AGE (10/3/2021), geniouxfacts, The 10 most read "genioux facts" of the week

- g-f(2)534 THE BIG PICTURE OF THE DIGITAL AGE (10/2/2021), AAAS, Learning curve

- g-f(2)533 THE BIG PICTURE OF THE DIGITAL AGE (10/2/2021), MIT Sloan, 7 lessons to ensure successful machine learning projects

- g-f(2)532 THE BIG PICTURE OF THE DIGITAL AGE (10/1/2021), Multiple sources, The half empty glass of artificial intelligence

- g-f(2)531 THE BIG PICTURE OF THE DIGITAL AGE (10/1/2021), AAAS, Active learning: “Hands-on” meets “minds-on”

- g-f(2)530 THE BIG PICTURE OF THE DIGITAL AGE (9/30/2021), Forbes, Artificial Intelligence: Poised To Transform The Massive Construction Industry

- g-f(2)529 THE BIG PICTURE OF THE DIGITAL AGE (9/30/2021), MIT SMR, Has COVID-19 Permanently Changed Business Strategy? What Experts Say

- g-f(2)528 THE BIG PICTURE OF THE DIGITAL AGE (9/30/2021), Nikkei Asia, Japan races to hire 270,000 artificial intelligence engineers

- g-f(2)527 THE BIG PICTURE OF THE DIGITAL AGE (9/29/2021), Forbes, Digital transformation series

- g-f(2)526 THE BIG PICTURE OF THE DIGITAL AGE (9/29/2021), MIT SMR, The Digital Superpowers You Need to Thrive

- g-f(2)525 THE BIG PICTURE OF THE DIGITAL AGE (9/29/2021), geniouxfacts, Trends in Artificial Intelligence (AI)

- g-f(2)524 THE BIG PICTURE OF THE DIGITAL AGE (9/28/2021), HBR, AI Adoption Skyrocketed Over the Last 18 Months

- g-f(2)523 THE BIG PICTURE OF THE DIGITAL AGE (9/28/2021), Gartner, Gartner Survey Reveals Talent Shortages as Biggest Barrier to Emerging Technologies Adoption

- g-f(2)522 THE BIG PICTURE OF THE DIGITAL AGE (9/28/2021), Forbes, May The Force Of Digital Transformation Be With You

- g-f(2)521 THE BIG PICTURE OF THE DIGITAL AGE (9/28/2021), ZDNet, Preparing for the 'golden age' of artificial intelligence and machine learning

- g-f(2)520 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (9/27/2021)

- g-f(2)519 THE BIG PICTURE OF THE DIGITAL AGE (9/27/2021), The Virtuous Circle of Managing Yourself in the g-f New World

- g-f(2)518 THE BIG PICTURE OF THE DIGITAL AGE (9/26/2021), Managing Yourself in the g-f New World

- g-f(2)517 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital Transformation (9/25/2021)

- g-f(2)516 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (9/25/2021)

- g-f(2)515 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (9/24/2021)

- g-f(2)514 The Big Picture of the Digital Age (9/23/2021), CIO, How Johnson Controls is going ‘digital to the core’

- g-f(2)513 The Big Picture of the Digital Age (9/23/2021), Forbes, Why The Era Of Digital Transformation Is Important For Companies Of All Sizes

- g-f(2)512 The Big Picture of the Digital Age (9/23/2021), geniouxfacts, The Unstoppable Advances Of Artificial Intelligence

- g-f(2)511 The Big Picture of the Digital Age (9/22/2021), geniouxfacts, Strategy Guide and Webinar Series: JOURNEY TO AI SUCCESS

- g-f(2)510 The Big Picture of the Digital Age (9/22/2021), geniouxfacts, Learning how to make your digital transformation successful

- g-f(2)509 The Big Picture of the Digital Age (9/22/2021), Insead Knowledge, The World’s Most Innovative Countries, 2021

- g-f(2)508 The Big Picture of the Digital Age (9/21/2021), HBR, Unartificial Intelligence

- g-f(2)507 THE BIG PICTURE OF THE DIGITAL AGE (9/21/2021), WSJ, Xi Jinping Aims to Rein In Chinese Capitalism, Hew to Mao’s Socialist Vision

- g-f(2)506 THE BIG PICTURE OF THE DIGITAL AGE (9/20/2021), geniouxfacts, Mahima Khatri and Sandeep Reddy analyze “Seven deadly sins of digital transformation”

- g-f(2)505 THE BIG PICTURE OF THE DIGITAL AGE (9/20/2021), The g-f New World

- g-f(2)504 Discover and exploit the New World by mastering "The Big Picture of the Digital Age"

- g-f(2)503 THE BIG PICTURE OF THE DIGITAL AGE (9/19/2021), geniouxfacts, A MIT SMR article is a “Full Pack Golden Knowledge Container”

- g-f(2)502 THE BIG PICTURE OF THE DIGITAL AGE (9/18/2021), geniouxfacts, A Forbes article is a “Full Pack Golden Knowledge Container”

- g-f(2)501 THE BIG PICTURE OF THE DIGITAL AGE (9/17/2021), MIT Sloan Executive Education, Disciplined Entrepreneurship with MIT's Bill Aulet

- g-f(2)500 The crowd needs to master "The Big Picture of the Digital Age" to unleash positive universal disruption

- g-f(2)499 THE BIG PICTURE OF THE DIGITAL AGE (9/16/2021), Forbes, Thoughtworks IPO: Riding The Digital Transformation Wave

- g-f(2)498 THE BIG PICTURE OF THE DIGITAL AGE (9/16/2021), Nextgov, Artificial Intelligence, Automation Aren’t Killing Labor Market, Reports Says

- g-f(2)497 Results of the “genioux facts" Research on "The Big Picture of the Digital Age" (9/15/2021): We Have a Unique Outstanding Opportunity

- g-f(2)496 The biggest challenging for leadership in the digital age (9/14/2021): Being digitally savvy and wisely exploiting the treasure

- g-f(2)495 The greatest challenge for humanity, today 9/13/2021: Wisely discover and exploit the real treasure of the digital age

- g-f(2)494 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, NEW WORLD Golden Knowledge Tweets (9/13/2021)

- g-f(2)493 THE BIG PICTURE OF THE DIGITAL AGE (9/13/2021), Newsweek, The U.S. Should Take Note of China's New Generation of Nationalists | Opinion

- g-f(2)492 THE BIG PICTURE OF THE DIGITAL AGE (9/13/2021), MIT SMR, The Digital Twin Opportunity

- g-f(2)491 THE BIG PICTURE OF THE DIGITAL AGE (9/12/2021), INSEAD Knowledge, Strategising for Success in Winner-Take-All Industries

- g-f(2)490 THE BIG PICTURE OF THE DIGITAL AGE (9/12/2021), geniouxfacts, HBR September–October 2021 Issue: A Golden Knowledge Mine

- g-f(2)489 THE BIG PICTURE OF THE DIGITAL AGE (9/12/2021), geniouxfacts, MIT SMR Fall 2021 Issue: A Golden Knowledge Mine

- g-f(2)488 THE BIG PICTURE OF THE DIGITAL AGE (9/11/2021), geniouxfacts, Opportunities: Pragmatic golden knowledge would skyrocket global growth

- g-f(2)487 THE BIG PICTURE OF THE DIGITAL AGE (9/11/2021), geniouxfacts, The technology giants brilliantly exploit the treasure of the digital age

- g-f(2)486 THE BIG PICTURE OF THE DIGITAL AGE (9/10/2021), Business Insider, One chart shows how poor even the top 1% is compared to billionaires — and how far behind the average American is

- g-f(2)485 THE BIG PICTURE OF THE DIGITAL AGE (9/10/2021), MIT Technology Review, A customer-centric approach is key in a post-pandemic world

- g-f(2)484 THE BIG PICTURE OF THE DIGITAL AGE (9/10/2021), geniouxfacts, The Three Golden Knowledge Search Engines to Fuel Your Growth

- g-f(2)483 THE BIG PICTURE OF THE DIGITAL AGE (9/9/2021), BLoC, Artificial Intelligence will be integrated into all disciplines

- g-f(2)482 THE BIG PICTURE OF THE DIGITAL AGE (9/9/2021), HBR, Ansys, How Simulation Can Accelerate Your Digital Transformation

- g-f(2)481 THE BIG PICTURE OF THE DIGITAL AGE (9/8/2021), TEDx Talks, Invest in the future one wants to create

- g-f(2)480 THE BIG PICTURE OF THE DIGITAL AGE (9/8/2021), Bizcommunity, Here's why technology needs to get out the way of digital transformation

- g-f(2)479 THE BIG PICTURE OF THE DIGITAL AGE (9/8/2021), Inside Sources, Artificial Intelligence and the Humanization of Medicine

- g-f(2)478 THE BIG PICTURE OF THE DIGITAL AGE (9/7/2021), CIO, CIO Think Tank: 5G in the enterprise

- g-f(2)477 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, NEW WORLD Golden Knowledge Tweets (9/7/2021)

- g-f(2)476 THE BIG PICTURE OF THE DIGITAL AGE (9/6/2021), Forbes, Video And Live Streaming Apps Are Fueling A New Social Media Boom

- g-f(2)475 THE BIG PICTURE OF THE DIGITAL AGE (9/6/2021), HBR, The Digital Economy Runs on Open Source. Here’s How to Protect It.

- g-f(2)474 THE BIG PICTURE OF THE DIGITAL AGE (9/5/2021), The Keenfolks, Digital Gap 2021

- g-f(2)473 THE BIG PICTURE OF THE DIGITAL AGE (9/5/2021), NYT, You Are Not Who You Think You Are

- g-f(2)472 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, Golden Knowledge (GK) in business artificial intelligence (9/4/2021)

- g-f(2)471 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, Golden knowledge (GK) in the digital customer experience (9/4/2021)

- g-f(2)470 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, Golden knowledge in leadership (9/3/2021)

- g-f(2)469 THE BIG PICTURE OF THE DIGITAL AGE, genioux facts, Relevant digital transformation trends (9/3/2021)

- g-f(2)468 THE BIG PICTURE OF THE DIGITAL AGE (9/2/2021), MIT SMR, Portrait of an AI Leader: Piyush Gupta of DBS Bank

- g-f(2)467 THE BIG PICTURE OF THE DIGITAL AGE (9/2/2021), Deloitte, Seven pivots for government’s digital transformation

- g-f(2)466 THE BIG PICTURE OF THE DIGITAL AGE (9/1/2021), CIO, Public cloud: 4 success stories

- g-f(2)465 THE BIG PICTURE OF THE DIGITAL AGE (9/1/2021), WSJ, Deloitte, Pandemic Hastens Governments’ Digital Transformation

- g-f(2)464 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Quotes of THE NEW WORLD (9/1/2021)

- g-f(2)463 THE BIG PICTURE OF THE DIGITAL AGE (8/31/2021), Forbes, Better Together: Striking The Balance Between Artificial And Human Intelligence

- g-f(2)462 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Quotes of THE NEW WORLD (8/31/2021)

- g-f(2)461 THE BIG PICTURE OF THE DIGITAL AGE (8/30/2021), McKinsey & Company, Boards, talent, and culture

- g-f(2)460 THE BIG PICTURE OF THE DIGITAL AGE (8/30/2021), genioux facts, The new world must be free from terrorism, violence, corruption, and the violation of human rights

- g-f(2)459 THE BIG PICTURE OF THE DIGITAL AGE (8/30/2021), WSJ, The Best of America

- g-f(2)458 THE BIG PICTURE OF THE DIGITAL AGE (8/30/2021), HBR, How Data Literate Is Your Company?

- g-f(2)457 THE BIG PICTURE OF THE DIGITAL AGE (8/29/2021), The Guardian, Constant craving: how digital media turned us all into dopamine addicts

- g-f(2)456 THE BIG PICTURE OF THE DIGITAL AGE (8/29/2021), WSJ, ESPN Explores Sports-Betting Deal Worth at Least $3 Billion

- g-f(2)455 THE BIG PICTURE OF THE DIGITAL AGE (8/28/2021), MIT SMR, Don’t Let Digital Obsession Destroy Your Organization

- g-f(2)454 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The BRAIN (8/27/2021)

- g-f(2)453 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The greatest pleasure in the NEW WORLD (8/27/2021)

- g-f(2)452 "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The essentials of THE NEW WORLD (8/26/2021)

- g-f(2)451 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Quotes of THE NEW WORLD (8/26/2021)

- g-f(2)450 THE BIG PICTURE OF THE DIGITAL AGE (8/26/2021), CIO, Digital twins: 4 success stories

- g-f(2)449 THE BIG PICTURE OF THE DIGITAL AGE (8/26/2021), WSJ, Microsoft Hires Former Top Amazon Cloud Executive, Adding to Rivalry

- g-f(2)448 THE BIG PICTURE OF THE DIGITAL AGE (8/25/2021), HBR, How to Speed Up Your Digital Transformation

- g-f(2)447 THE BIG PICTURE OF THE DIGITAL AGE, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The essentials of THE NEW WORLD (8/25/2021)

- g-f(2)446 THE BIG PICTURE OF THE DIGITAL AGE, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The treasure in the days of noise (8/25/2021)

- g-f(2)445 THE BIG PICTURE OF THE DIGITAL AGE, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, THE NEW WORLD (8/25/2021)

- g-f(2)444 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial intelligence cases (8/24/2021)

- g-f(2)443 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Quantum Computing (8/24/2021)

- g-f(2)442 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, The virtuous circle of wisdom that unleashes your growth without limits (8/23/2021)

- g-f(2)441 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, The vicious circle of ignorance that blocks your growth without limits (8/23/2021)

- g-f(2)440 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Overcoming the vicious cycle of ignorance (8/21/2021)

- g-f(2)439 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, The cognitive flexibility (8/22/2021)

- g-f(2)438 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (8/21/2021)

- g-f(2)437 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital transformation driven by MIT SMR (8/21/2021)

- g-f(2)436 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, THE ESSENTIAL (8/20/2021)

- g-f(2)435 THE BIG PICTURE OF THE DIGITAL AGE (8/19/2021), MIT SMR, Strategy as a Way of Life

- g-f(2)434 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (8/19/2021)

- g-f(2)433 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital Transformation (8/19/2021)

- g-f(2)432 THE BIG PICTURE OF THE DIGITAL AGE (8/18/2021), MIT SMR, Why Every Executive Should Be Focusing on Culture Change Now

- g-f(2)431 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Artificial Intelligence (8/18/2021)

- g-f(2)430 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital Transformation (8/18/2021)

- g-f(2)429 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital Transformation (8/17/2021)

- g-f(2)428 THE BIG PICTURE OF THE DIGITAL AGE (8/16/2021), HBR, Do You Have the Right Software for Your Digital Transformation?

- g-f(2)427 THE BIG PICTURE OF THE DIGITAL AGE, geniouxfacts, "g-f" fishing of golden knowledge (GK) of the fabulous treasure of the digital age, Digital Transformation (8/16/2021)

- g-f(2)426 THE BIG PICTURE OF THE DIGITAL AGE (8/16/2021), geniouxfacts, Fishing for golden knowledge that is part of the treasure of the digital age

- g-f(2)425 THE BIG PICTURE OF THE DIGITAL AGE (8/15/2021), geniouxfacts, Every leader has to demonstrate his greatness by brilliantly exploiting, for his people, the treasure of the digital age

- g-f(2)423 THE BIG PICTURE OF THE DIGITAL AGE (8/13/2021), Forbes, The Evolution Of Digital Transformation

- g-f(2)422 THE BIG PICTURE OF THE DIGITAL AGE (8/12/2021), MIT Sloan, 6 trends in data and artificial intelligence for 2021 and beyond

- g-f(2)421 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (8/12/2021), IDG Communications, Businesses Invest in Artificial Intelligence & Machine Learning to Expand Digital Business Plans

- g-f(2)420 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (8/12/2021), Research and Markets, Worldwide Artificial Intelligence Services Industry to 2030

- g-f(2)419 THE BIG PICTURE OF THE DIGITAL AGE (8/12/2021), geniouxfacts, In your big picture your digital transformation is important

- g-f(2)418 THE BIG PICTURE OF THE DIGITAL AGE (8/11/2021), geniouxfacts, From a nugget of golden knowledge to hundreds of mines of golden knowledge

- g-f(2)417 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (8/11/2021), Talks at Google, Jeff Hawkins & Subutai Ahmad | A Thousand Brains: A New Theory of Intelligence | Talks at Google

- g-f(2)416 THE BIG PICTURE OF THE DIGITAL AGE (8/10/2021), geniouxfacts, The big picture of sports teaches the value of co-opetition and resilience

- g-f(2)415 THE BIG PICTURE OF THE DIGITAL AGE (8/10/2021), HBR, Softening Capitalism’s Downsides

- g-f(2)414 THE BIG PICTURE OF THE DIGITAL AGE (8/9/2021), geniouxfacts, The China that makes us fall in love: talent, brilliance and solidarity

- g-f(2)413 THE BIG PICTURE OF THE DIGITAL AGE (8/9/2021), geniouxfacts, Tokyo 2020 (2021) has been an oasis of hope for humanity

- g-f(2)412 THE BIG PICTURE OF THE DIGITAL AGE (8/8/2021), YAHOO SPORTS, U.S. rallies to top China in Tokyo Olympics gold medal tally

- g-f(2)411 THE BIG PICTURE OF THE DIGITAL AGE (8/7/2021), geniouxfacts, A picture is worth a thousand words

- g-f(2)410 THE BIG PICTURE OF THE DIGITAL AGE (8/6/2021), CIO, Five big ideas for reinventing IT

- g-f(2)409 THE BIG PICTURE OF THE DIGITAL AGE (8/6/2021), HBR, The Rules of Co-opetition

- g-f(2)408 THE BIG PICTURE OF THE DIGITAL AGE (8/5/2021), geniouxfacts, HBR Magazine, July to August 2021, is a mine of exceptional golden knowledge

- g-f(2)406 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (8/3/2021), MIT SMR, Achieving Return on AI Projects

- g-f(2)405 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (8/3/2021), MEDIA, Google is getting serious about the future of its smartphone business

- g-f(2)404 THE BIG PICTURE OF THE DIGITAL AGE (8/2/2021), Inc., Tim Cook's Apple Is Facing the Unthinkable: Cracks in Its Perfectly Polished Image

- g-f(2)403 THE BIG PICTURE OF THE DIGITAL AGE (8/1/2021), Forbes, Better Than Values: Mandatory Principles

- g-f(2)402 THE BIG PICTURE OF THE DIGITAL AGE (7/31/2021), geniouxfacts, The new world needs a universal digital culture with clear universal principles and values

- g-f(2)401 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (7/30/2021), Forbes, Four Steps Before Investing In Artificial Intelligence

- g-f(2)400 THE BIG PICTURE OF THE DIGITAL AGE (7/29/2021), BCG, YouTube Channel, Craft a Clear Integrated Strategy

- g-f(2)399 THE BIG PICTURE OF THE DIGITAL AGE (7/29/2021), BCG, Helping companies achieve sustainability as advantage

- g-f(2)398 THE BIG PICTURE OF THE DIGITAL AGE (7/29/2021), BCG, Why the New Competitive Advantage Demands Sustainability

- g-f(2)396 THE BIG PICTURE OF THE DIGITAL AGE (7/28/2021), Insead Knowledge, Two CEOs, No Drama: Ground Rules for Co-Leadership

- g-f(2)393 THE BIG PICTURE OF THE DIGITAL AGE (7/26/2021), geniouxfacts, The digital age is growth with meaning to together improve the world

- g-f(2)392 THE BIG PICTURE OF BUSINESS ARTIFICIAL INTELLIGENCE (7/25/2021), Phys.org, Artificial intelligence helps improve NASA's eyes on the Sun

- g-f(2)391 THE BIG PICTURE OF THE DIGITAL AGE (7/24/2021), MIT Sloan Executive Education, Becoming a Digital Master in Today's Changing World

- g-f(2)390 THE BIG PICTURE OF THE DIGITAL AGE (7/23/2021), MIT SMR, Accelerate Digital Transformation With ‘No-Code’ Software Tools

- g-f(2)388 The Big Picture of Business Artificial Intelligence (7/22/2021), NYTimes, A.I. Predicts the Shapes of Molecules to Come

- g-f(2)387 THE BIG PICTURE OF THE DIGITAL AGE (7/22/2021), geniouxfacts, Challenge: Feed the entire pyramid of humanity with golden knowledge

- g-f(2)386 The Big Picture of Business Artificial Intelligence (7/21/2021), STAT, Explaining medical AI is easier said than done.

- g-f(2)385 THE BIG PICTURE OF THE DIGITAL AGE (7/21/2021), WSJ, Investigation: How TikTok's Algorithm Figures Out Your Deepest Desire

- g-f(2)384 THE BIG PICTURE OF THE DIGITAL AGE (7/21/2021), geniouxfacts, The digital age is the age of freedom, especially the freedom to dream!

- g-f(2)383 The Big Picture of Business Artificial Intelligence (7/20/2021), yahoo!finance/Cision, Global Personal Artificial Intelligence and Robotics Market Report 2021: Personalized Robot Components will Reach $15.0 Billion by 2026.

- g-f(2)382 The Big Picture of the Digital Age, Untapped free golden knowledge of exceptional quality, YouTube channel, MITSMR, MIT Sloan Management Review, 7/20/2021.

- g-f(2)381 The Big Picture of the Digital Age (7/19/2021), geniouxfacts, Observing the new world with our exceptional general natural intelligence.

- g-f(2)380 The Big Picture of Business Artificial Intelligence (7/17/2021), VB, The future of deep learning, according to its pioneers

- g-f(2)379 The big picture of the digital age (7/17/2021), geniouxfacts, The treasure of the digital age is not available to the entire pyramid of humanity!

- g-f(2)378 The big picture of the digital age (7/16/2021), Media, The digital age unmasks the failed Cuban communist system

- g-f(2)377 The Big Picture of Business Artificial Intelligence (7/16/2021), Phys.org, New artificial intelligence software can compute protein structures in 10 minutes

- g-f(2)375 The Big Picture of Business Artificial Intelligence (7/15/2021), MIT Sloan, How to prepare for the AI productivity boom

- g-f(2)374 The big picture of the digital age, Untapped free golden knowledge of exceptional quality, YouTube Channel, Wharton School, 7/14/2021.

- g-f(2)370 The Big Picture of Business Artificial Intelligence (7/13/2021), PRNewswire, IoT Machine Learning and Artificial Intelligence Services to Reach US$3.6 Billion in Revenue in 2026

- g-f(2)369 The big picture of the digital age (7/12/2021), The Atlantic, KILL THE 5-DAY WORKWEEK

- g-f(2)368 The big picture of the digital age (7/12/2021), The Atlantic, The Pandemic Did Not Affect Mental Health the Way You Think

- g-f(2)367 The Big Picture of Business Artificial Intelligence (7/12/2021), Wired, Need to Fit Billions of Transistors on a Chip? Let AI Do It

- g-f(2)366 The big picture of your life (7/11/2021), geniouxfacts, Fishing for Golden Knowledge in the age of abundance

- g-f(2)365 The big picture of your life (7/10/2021), geniouxfacts, The digital age offers you a wonderful treasure tailor-made for you

- g-f(2)364 The big picture of your life (7/9/2021), geniouxfacts, The path to your greatness and your Personal Digital Transformation (PDT) in a “g-f KBP” Chart.

- g-f(2)363 The big picture of the digital age (7/8/2021), ASCM, COVID-19 Accelerates Technological Change

- g-f(2)362 The big picture of the digital age (7/8/2021), CIO, Predictive analytics: 4 success stories

- g-f(2)361 The big picture of the digital age (7/7/2021), MIT SMR, Summer 2021 Issue

- g-f(2)360 The big picture of the digital age (7/7/2021), HBR, Magazine (July–August 2021)

- g-f(2)359 The big picture of the digital age (7/6/2021), MIT SMR, Leadership at a Time When Every Company Is a Tech Company

- g-f(2)357 The big picture of the digital age (7/5/2021), The Week, Microsoft's quiet triumph

- g-f(2)356 The big picture of the digital age (7/4/2021), geniouxfacts, Challenge: Discover the treasure of the digital age

- g-f(2)355 The big picture of your life (7/3/2021), geniouxfacts, Enjoy the greatest pleasure of learning with the “g-f” golden juices of knowledge

- g-f(2)353 The big picture of the digital transformation (7/2/2021), WEF, Digital Culture: The Driving Force of Digital Transformation

- g-f(2)343 The big picture of the digital age (6/26/2021), geniouxfacts, Learn to Fish Golden Knowledge (GK) to Unleash Your Unlimited Growth

- g-f(2)346 The big picture of your life (6/28/2021), geniouxfacts, All who fish for Golden Knowledge (GK) to grow find

- g-f(2)339 The big picture of your life (6/24/2021), geniouxfacts, Take advantage of the wisdom of geniuses applied to the digital age

- g-f(2)338 The big picture of your life (6/24/2021), geniouxfacts, Take advantage of popular wisdom applied to the digital age

- The big picture of your life can drastically limit your growth, or it can open up unimaginable opportunities.

- Your Personal Digital Transformation (PDT) is potentially wonderful and disruptive!

- g-f(2)334 The big picture of the digital age (6/21/2021), WSJ, U.S. Economy Is Bouncing Back From Covid-19. Now Foreign Investors Are Rushing In.

- g-f(2)333 The big picture of the digital age (6/20/2021), geniouxfacts, How AI teaches how to optimize human intelligence

- g-f(2)332 The Big Picture of Business Artificial Intelligence (6/20/2021), IBM, Global Data from IBM Points to AI Growth as Businesses Strive for Resilience

- g-f(2)331 The Big Picture of Business Artificial Intelligence (6/20/2021), IBM, Global AI Adoption Index 2021

- g-f(2)320 The Big Picture of Business Artificial Intelligence (6/14/2021), VB, DeepMind says reinforcement learning is ‘enough’ to reach general AI

- g-f(2)249 The Big Picture of the Digital Age (4/28/2021), geniouxfacts, There are emerging technologies and multidisciplinary knowledge that can radically improve the world.

- g-f(2)314 The big picture of the digital age (6/9/2021), NYT, Media, Senate Passes Bill to Bolster Competitiveness With China!

- g-f(2)312 Ultra Condensed Golden Knowledge Juice: In the current big picture of the digital age (6/8/2021), your Personal Digital Transformation (PDT) is potentially wonderful and disruptive!

- g-f(2)311 The big picture of the digital age (6/7/2021), MIT SMR, How a Startup Mindset Brews Innovation at a Global Scale

- g-f(2)310 The big picture of the digital age (6/7/2021), WSJ, FBI Director Compares Ransomware Challenge to 9/11.

- g-f(2)309 The big picture of the digital age (6/6/2021), geniouxfacts, Ultra Condensed Golden Knowledge Juice: In the current state of the art Digital Transformation (DT) is wonderful and potentially disruptive!

- g-f(2)308 The Big Picture of Business Artificial Intelligence (6/5/2021), geniouxfacts, Ultra Condensed Golden Knowledge Juice: AI in Its Current State Is Already Wonderful.

- g-f(2)307 The Big Picture of Business Artificial Intelligence (6/3/2021), MIT Technology Review, AI is learning how to create itself.

- g-f(2)302 The big picture of the digital age (5/31/2021), MIT SMR, Self-Sufficient Production Following the Pandemic.

- g-f(2)301 The big picture of the digital age (5/30/2021), MIT SMR, Digital Fabrication During the COVID-19 Pandemic.

- g-f(2)300 The big picture of the digital age, Untapped free golden knowledge of exceptional quality, Boston Global Forum YouTube channel, 5/30/2021.

- g-f(2)299 The big picture of the digital age, MIT SMR, THE THIRD DIGITAL REVOLUTION: 10 relevant lessons learned (5/30/2021).

- g-f(2)126 THE BIG PICTURE OF THE DIGITAL AGE, MIT SMR, The Promise of Self-Sufficient Production. Digital fabrication represents a third digital revolution.

- g-f(2)254 The Big Picture of the Digital Age (5/1/2021), geniouxfacts, The Golden Knowledge Path (GKPath) to accelerate everyone's success.

- g-f(2)260 The Big Picture of the Digital Age (5/4/2021), geniouxfacts, Alerts, Warnings and Relevant Lessons Learned Traveling at High Speed on GKPath.

- g-f(2)271 The Big Picture of the Digital Age (5/11/2021), geniouxfacts, The inverted pyramid of knowledge of a “genioux fact fast solution”: From GOLD JUICES to GOLD FRUITS.

- g-f(2)256 The Big Picture of the Digital Age (5/2/2021), geniouxfacts, The fundamental knowledge mini-pyramid for traveling on the "GKPath" highway.

- A list of relevant "genioux facts" that describe a "Classical CONTEXT" of the Digital Age

- g-f(2)45 "The Big Picture of the Digital Age": Knowledge opens the way to staggering opportunities, risks and challenges

- g-f(2)50 The Big Picture of the Digital Age: Mines of Golden Knowledge Growing Every Day

- g-f(2)74 THE BIG PICTURE OF THE DIGITAL AGE: Rapid change, incertitude and disruption, in a hypercompetitive environment

- g-f(1)28 The pyramid of knowledge of a “genioux fact”: From GOLD FRUITS to GOLD JUICES

- g-f(2)51 The Big Picture of the Digital Age: The Value of Golden Knowledge is Relative

- g-f(2)99 THE BIG PICTURE OF THE DIGITAL AGE, The “genioux facts”: Essential knowledge to unleash your limitless growth.

- g-f(2)75 THE BIG PICTURE OF THE DIGITAL AGE: “Infinite Learners” to keep pace with change, incertitude and disruption, in a hypercompetitive environment

- g-f(2)151 The Big Picture of the Digital Transformation, 3/1/2021, geniouxfacts, How To Succeed At Business Digital Transformation.

- g-f(2)153 The Big Picture of Business Artificial Intelligence (3/3/2021) in a Single “g-f KBP” Chart

- g-f(2)174 THE BIG PICTURE OF THE DIGITAL AGE (3/20/2021), geniouxfacts, Executive guide of golden knowledge to fire up your unlimited growth.

- Some key searches on the blog

- Showing posts sorted by relevance for query The Big Picture of the Digital Age

- Showing posts sorted by relevance for query Digital transformation.

- Showing posts sorted by relevance for query Artificial Intelligence.

- Showing posts sorted by relevance for query The future of work.

- Showing posts sorted by date for query The Big Picture of Sports.

- Showing posts sorted by relevance for query A new, better world for everyone.

3997%20The%20Prism%20of%20Transformation%20(The%20Cover%20Image).png)

3906%20Cover%20with%20Title,%20subtitle,%20OID%20and%20Abstract.png)

3933%20Cover%20with%20OID.png)

3819%20Cover%20with%20title%20and%20subtitle.png)

3932%20Cover%20with%20Title,%20and%20OID.png)

3985%20Cover,%20General.png)

3884%20Cover%20with%20Titel,%20subtitle,%20OID%20and%20g-f%20GK%20Nugget.png)

3930%20Cover%20OID.png)

3941%20Cover,%20Gemini.png)

3660%20Cover%20Image.png)

3957%20Cover%20with%20Title%20and%20OID,%20FV.png)