Extra-condensed knowledge

FinTech is the application of technology and innovation to solve the needs of consumers and firms in the financial space — think credit cards, online banking, and blockchain-powered cryptocurrencies.

- For over sixty years, the U.S. was the leading innovator of financial technology (or FinTech) in the world.

- While the U.S. produced the first major wave of innovation in this sector, it has fallen behind as firms and consumers have reached the innovative doldrums of “good enough.”

- Over the past decade, however, China has become the global leader: Powered by smartphones and social apps, China has used remote payments and the digitization of money management to build a steady vehicle of financial inclusion.

- It may not be the leader for long.

- Recently, African countries such as Nigeria and Kenya have emerged as FinTech hotbeds, and are using inexpensive, accessible tech to mobilize consumers in ways never seen before.

Genioux knowledge fact condensed as an image

Condensed knowledge

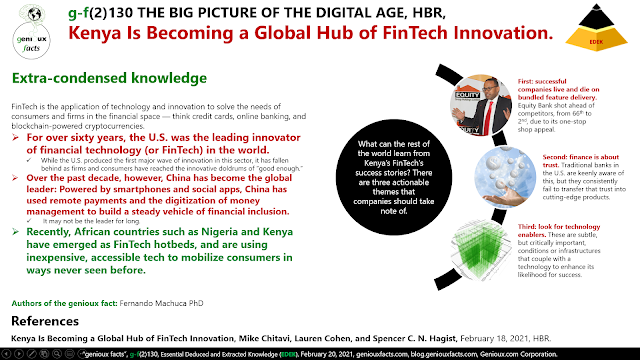

- What can the rest of the world learn from Kenya’s FinTech’s success stories? There are three actionable themes that companies should take note of.

- First: successful companies live and die on bundled feature delivery. Equity Bank shot ahead of competitors, from 66th to 2nd, due to its one-stop shop appeal.

- Second: finance is about trust. Traditional banks in the U.S. are keenly aware of this, but they consistently fail to transfer that trust into cutting-edge products.

- Third: look for technology enablers. These are subtle, but critically important, conditions or infrastructures that couple with a technology to enhance its likelihood for success.

Category 2: The Big Picture of the Digital Age

[genioux fact produced, deduced or extracted from HBR]

Type of essential knowledge of this “genioux fact”: Essential Deduced and Extracted Knowledge (EDEK).

Type of validity of the "genioux fact".

- Inherited from sources + Supported by the knowledge of one or more experts.

Authors of the genioux fact

Fernando Machuca

References

ABOUT THE AUTHORS

Mike Chitavi is a Visiting Assistant Professor of Finance at The Citadel College, The Military College of South Carolina. Dr. Chitavi received his Doctorate in Business Administration (DBA) in Finance from University of Wisconsin at Whitewater, and his MBA in Analytic Finance, Entrepreneurship and Innovation from the Kellogg School of Management at Northwestern University. He earned his undergraduate degree from Kenyatta University in Nairobi, Kenya and Higher Diploma in Computer Audit from The University of Witwatersrand, Johannesburg, South Africa. At The Citadel College, he teaches in the MBA and undergraduate programs.

Lauren Cohen is the L.E. Simmons Professor in the Finance & Entrepreneurial Management Units at Harvard Business School and a Research Associate at the National Bureau of Economic Research. He is an Editor of the Review of Financial Studies, along with being a past Editor of Management Science. Professor Cohen teaches in the MBA, Executive Education, and Doctoral Programs at the Harvard Business School. He is a Designer and Chair of the HarvardX Fintech course, along with the HBS Executive Education course Building a Legacy: Family Office Wealth Management.

Spencer C. N. Hagist is a Research Associate in the Finance & Entrepreneurial Management Units at Harvard Business School. Under Professor Lauren Cohen, he has written cases for MBA and Executive Education courses, as well as content for the HBS Digital Initiative. His research topics include FinTech and family offices and businesses in addition to international development, finance, and trade, particularly between developed and developing countries.

3997%20The%20Prism%20of%20Transformation%20(The%20Cover%20Image).png)

3906%20Cover%20with%20Title,%20subtitle,%20OID%20and%20Abstract.png)

3933%20Cover%20with%20OID.png)

3819%20Cover%20with%20title%20and%20subtitle.png)

3955%20The%208-Layer%20Pyramid%20of%20Transformation.png)

3932%20Cover%20with%20Title,%20and%20OID.png)

3957%20Cover%20with%20Title%20and%20OID,%20FV.png)

3945%20Cover%20with%20OID.png)

3941%20Cover,%20Gemini.png)

3956%20Cover%20with%20Title%20and%20OID.png)

3969%20Cover%20with%20OID.png)